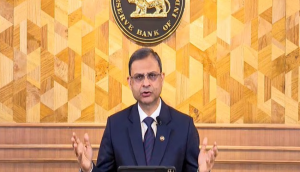

Mumbai (Maharashtra): In his first Monetary Policy announcement on Friday, Reserve Bank of India (RBI) Governor Sanjay Malhotra stated that the Monetary Policy Committee (MPC) had unanimously decided to reduce the policy rate by 25 basis points (bps) from 6.5 per cent to 6.25 per cent.

Global economic challenges persist

Malhotra highlighted the challenges posed by the global economic landscape, noting that while high-frequency indicators suggest resilience and expansion in trade, overall global growth remains below historical averages. "Progress on global disinflation is stalling, hindered by services price inflation," Malhotra said.

Impact of US monetary policy on markets

Discussing global financial market dynamics, Malhotra pointed out that expectations regarding the size and pace of rate cuts in the United States had led to a strengthening of the US dollar.

He said, "The global economic backdrop remains challenging. The global economy is growing below the historical average, even though high-frequency indicators suggest resilience, along with continued expansion in trade. Progress on global disinflation is stalling, hindered by services price inflation."

Capital outflows and currency depreciation

This, in turn, resulted in hardened bond yields and significant capital outflows from emerging markets, causing sharp currency depreciations and tighter financial conditions.

He said, "With receiving expectations on the size and pace of rate cuts in the US, the US dollar has strengthened. Bond yields have hardened, emerging market economies have witnessed large capital outflows, leading to sharp depreciation of their currencies and tightening of financial conditions, divergent trajectories of monetary policy across advanced economies, lingering geopolitical tensions and elevated trade and policy uncertainties have exacerbated financial market volatility."

Geopolitical tensions add to volatility

He also emphasized the impact of geopolitical tensions and policy uncertainties on market volatility, adding that such an unpredictable global environment has posed significant policy trade-offs for emerging economies.

India's economic resilience amid global pressures

Despite these headwinds, Malhotra assured that the Indian economy remains strong and resilient, though not entirely immune to external pressures.

"The Indian rupee has come under depreciation pressure in recent months," he acknowledged. However, he reassured that the RBI is actively using all available tools to address the multifaceted challenges facing the economy.

Previous MPC decisions and policy direction

The MPC began its three-day meeting to discuss and set the new interest rates on February 5, 2025.

During the previous MPC meeting in December 2024, the RBI announced a 50 basis point cut in the cash reserve ratio (CRR), making it 4 per cent. However, it kept the benchmark repo rate unchanged at 6.5 per cent.

(With ANI Inputs)

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)